บัตรเครดิต กรุงศรี เจซีบี แพลทินัม

J Dining – Enjoy Exclusive Discounts & Cashback

J Shopping – Enjoy Spending Across Asia

J Service – Airport Lounge Access for JCB Cardholders

Travel Insurance – Up to 6 MB.*

Zero Liability Protection* – Secure Your Krungsri JCB Platinum Credit Card Purchases

J Privilege – 1%* Cashback on Gas at Bangchak Gas Station

“Krungsri Point” every THB 25 = 1 Point

Additional for JCB Credit Card Benefits

Application Criteria

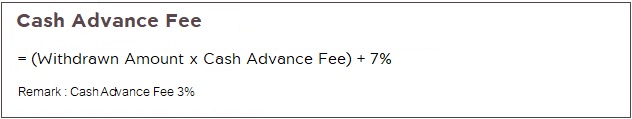

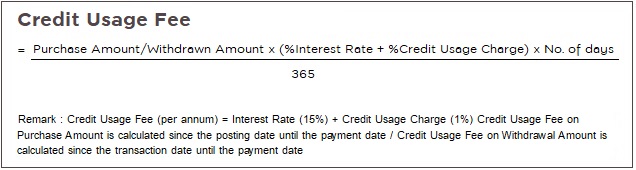

Fee

.png?lang=th-TH&ext=.png)

Terms & Conditions

Payment Channels

What is the Krungsri JCB Platinum Credit Card?

The Krungsri JCB Platinum Credit Card is the ideal financial companion for those who love dining, shopping, and traveling. It provides users airport lounge access, exclusive rewards, and cashback offers in Japan, South Korea, Hong Kong, Taiwan, and Singapore, making it the optimal credit card for international travelers.

Who Should Apply for a Krungsri JCB Platinum Credit Card?

This Krungsri JCB Platinum Credit Card is perfect for travelers who frequently visit Japan, South Korea, Hong Kong, Taiwan, and Singapore. Cardholders enjoy airport lounge access at major Asian airports such as Japan and more, plus up to 3% cashback on dining and shopping at participating countries.

Key Features of the Krungsri JCB Platinum Credit Card

Earn 1 reward point for every THB 25 spent with your Krungsri JCB Platinum Credit Card and redeem exclusive privileges via the UCHOOSE app. Enjoy restaurant discounts, cashback rewards, and travel insurance coverage up to 6 million THB. Plus, stay protected with Zero Liability Protection, covering unauthorized transactions up to 24 hours before the card is reported lost or stolen. Spend confidently anywhere in the world!

Wondering which bank offers the best JCB Credit Card? Choose Krungsri JCB Platinum Credit Card and enjoy premium privileges tailored for travelers. Apply today and enjoy cashback, airport lounge access, and exclusive travel perks, making every trip more rewarding!

สมัครเลย

กรุณากรอกข้อมูลของท่านให้ครบถ้วนทุกช่อง เพื่อให้เจ้าหน้าที่ติดต่อกลับแจ้งสิทธิประโยชน์และวิธีสมัคร

กรุณากรอกข้อมูลของท่านให้ครบถ้วนทุกช่อง เพื่อให้เจ้าหน้าที่ติดต่อกลับแจ้งสิทธิประโยชน์และวิธีสมัคร

| *,** เงื่อนไขเป็นไปตามที่บริษัทฯ กำหนด |

(1) พนักงานธนาคารกรุงศรีอยุธยา จำกัด (มหาชน) บริษัท บัตรกรุงศรีอยุธยาจำกัด และบริษัทในเครือไม่สามารถสมัครบัตรผ่านช่องทางนี้ได้

(2) *บริษัทฯ สงวนสิทธิ์ในการเก็บค่าธรรมเนียมรายปีในกรณีที่บัญชีของสมาชิกบัตรไม่มีการเคลื่อนไหวเป็นเวลาติดต่อกัน ตั้งแต่ 12 เดือนขึ้นไป

(3) **สิทธิพิเศษนี้เฉพาะสมาชิกสมัครบัตรใหม่ใบแรก (บัตรหลัก) เท่านั้น (สมาชิกสมัครบัตรใหม่ใบแรกคือ ผู้ที่ไม่เคยถือบัตรเครดิต กรุงศรี ทุกประเภท ที่ออกให้โดย บริษัท บัตรกรุงศรีอยุธยา จำกัด มาก่อน หรือยกเลิกบัตรมาแล้วไม่ต่ำกว่า 6 เดือน) สมัครบัตรผ่านช่องทางเว็บไซต์ (www.krungsricard.com) และได้รับการอนุมัติบัตรตั้งแต่วันที่ 1 ต.ค. 68 – 31 ม.ค. 69 ท่านจะได้รับกระเป๋าเป้ VALENTINO RUDY ขนาดกว้าง 8 x ยาว 11.5 x สูง 19 นิ้ว จำนวน 1 ใบ มูลค่า 2,590 บาท เมื่อมียอดใช้จ่ายสะสมผ่านบัตรครบ 15,000 บาทขึ้นไป ภายใน 30 วันหลังจากบัตรได้รับการอนุมัติ หรือ เมื่อสมัครรับใบแจ้งยอดบัญชีอิเล็กทรอนิกส์ (E-STATEMENT) ใช้จ่ายสะสมผ่านบัตรเพียง 12,000 บาทขึ้นไป ภายใน 30 วันหลังจากบัตรได้รับการอนุมัติ

(4) ยอดใช้จ่ายสะสมผ่านบัตรหลักไม่นับรวม รายการยอดถอนหรือบริการเงินสดผ่านทุกช่องทาง, ยอดใช้จ่ายหมวดประกันทุกประเภทและยูนิตลิงค์ (UNIT LINK) , ยอดใช้จ่ายหมวดกองทุนรวมทุกประเภท, การซื้อหน่วยลงทุนต่างๆ, การทำธุรกรรมเกี่ยวกับสินทรัพย์ดิจิทัล (Digital Asset) และคริปโทเคอร์เรนซี (Cryptocurrency) รวมถึงโบรคเกอร์ซื้อขายหุ้นต่างๆดอกเบี้ย, ค่าธรรมเนียมต่างๆ, ค่าปรับ, รายการใช้จ่ายที่ยกเลิกหรือยอดค่าใช้จ่ายที่มีการคืนสินค้าในภายหลัง, ยอดใช้จ่ายที่เอื้อผลประโยชน์ทางธุรกิจและ/หรือผลประโยชน์ส่วนตัวแก่ผู้ถือบัตรโดยทางตรงและทางอ้อมในเชิงพาณิชย์หรือเพื่อให้ได้รับสิทธิประโยชน์จากรายการส่งเสริมการขาย, การใช้จ่ายที่ไม่เป็นไปตามเงื่อนไขใช้บัตรเครดิตหรือการกระทำใดที่ผิดกฎหมาย, รายการที่ใช้จ่ายผ่านเครื่องรับบัตรเครดิต (EDC) ในกิจการของผู้ถือบัตรเอง หรือมีส่วนเกี่ยวข้องกับเจ้าของกิจการ

(5) สงวนสิทธิ์การรับของสมนาคุณ 1 ชิ้นต่อลูกค้า 1 ท่านตลอดรายการ

(6) รายการส่งเสริมการขายนี้ไม่สามารถใช้ร่วมกับรายการส่งเสริมการขายอื่นๆ ได้

(7) ของสมนาคุณไม่สามารถแลก, เปลี่ยน, ทอน หรือคืนเป็นเงินสดได้

(8) บริษัทฯ จะจัดส่งของสมนาคุณแก่ท่านสมาชิกตามที่อยู่ในใบแจ้งยอดบัญชี ดังนี้

- สมาชิกใหม่ที่อนุมัติบัตรตั้งแต่วันที่ 1 ต.ค. 68 - 31 ต.ค. 68 ส่งของสมนาคุณภายในวันที่ 28 ก.พ. 69

- สมาชิกใหม่ที่อนุมัติบัตรตั้งแต่วันที่ 1 พ.ย. 68 – 30 พ.ย. 68 ส่งของสมนาคุณภายในวันที่ 31 มี.ค. 69

- สมาชิกใหม่ที่อนุมัติบัตรตั้งแต่วันที่ 1 ธ.ค. 68 - 31 ธ.ค. 68 ส่งของสมนาคุณภายในวันที่ 30 เม.ย. 69

- สมาชิกใหม่ที่อนุมัติบัตรตั้งแต่วันที่ 1 ม.ค. 69 – 31 ม.ค. 69 ส่งของสมนาคุณภายในวันที่ 31 พ.ค. 69

(10) บริษัทฯ จะงด/ระงับการให้สิทธิประโยชน์ หรือเรียกคืนสิทธิประโยชน์ (รวมทั้งคะแนนสะสม) หรือเรียกเก็บเงินจากบัญชีบัตรเครดิตของสมาชิกบัตรตามมูลค่าของสิทธิประโยชน์ที่สมาชิกบัตรได้รับ ในกรณีที่มีการให้สิทธิประโยชน์ไปโดยผิดหลง หรือกรณีที่สมาชิกบัตรยกเลิก/ปฏิเสธรายการหรือการชำระเงินในภายหลัง (แบบเต็มจำนวนทั้งหมดและบางส่วน) หรือกรณีที่ยอดใช้จ่ายเกิดจากการใช้วงเงินที่ชำระไว้เกิน หรือวงเงินชั่วคราว หรือกรณีมีการใช้สิทธิเข้าร่วมรายการโดยไม่สุจริต ทุจริต ฉ้อฉลเพื่อให้ได้มาซึ่งสิทธิประโยชน์ หรือกรณีใช้บัตรเครดิตเพื่อผลประโยชน์ทางการค้า/หรือใช้บัตรเครดิตซื้อสินค้า/บริการของร้านค้าซึ่งสมาชิกผู้ถือบัตรมีส่วนได้เสียทั้งทางตรงและทางอ้อมหรือใช้บัตรผิดวัตถุประสงค์ของการใช้บัตรเครดิตเพื่อซื้อสินค้า/บริการหรือไม่เป็นไปตามสัญญาบัตรเครดิตหรือสัญญาสินเชื่อส่วนบุคคล (แล้วแต่กรณี) หรือการทำธุรกรรมเกี่ยวกับสินทรัพย์ดิจิทัล (Digital Asset) หรือคริปโทเคอร์เรนซี (Cryptocurrency)

(11) เงื่อนไขรายการส่งเสริมการขายเป็นไปตามที่บริษัทฯ กำหนด

(12) ให้บริการสินเชื่อโดย บริษัท บัตรกรุงศรีอยุธยา จำกัด

|

|

.png?lang=en-US&ext=.png)

.jpg?lang=th-TH&ext=.jpg)

.jpg?lang=th-TH&ext=.jpg)

.png?lang=th-TH&ext=.png)